Cairo, 2029 – Match Day at 44°C

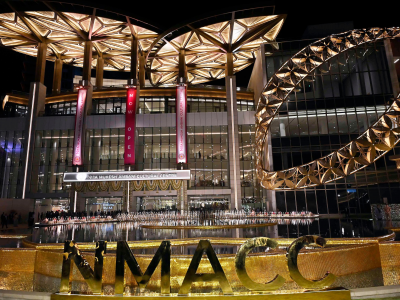

The streets shimmer. The air feels like it’s been ladled straight from a pot of boiling water. Somewhere beyond the haze, in Sheikh Zayed City, a gleaming new landmark rises — a 42,000-seat bowl sunk deep into the earth, wrapped in a shimmering digital skin.

This is Al-Ahly Football Club’s climate-smart fortress, four years in the making. It was designed not just to host football, but to defy Cairo’s heatwave trendlines.

On paper, it’s a masterpiece of design risk-taking: a sunken pitch for passive cooling, an asymmetrical cable-net roof to cast shadow and channel airflow, and a digital façade promising nighttime spectacle.

But today is no ordinary day. The thermometer has smashed records. Fans, players, sponsors, broadcasters — they’re all about to see whether the stadium’s risk appetite for innovation has matched its ability to manage residual risk.

A Strategic Initiative in Risk Terms

When Al-Ahly announced the project in 2025, it wasn’t just building a stadium. It was launching an enterprise risk management strategy with a clear objective: create a venue that thrives under extreme heat, protects players and fans, and builds long-term commercial value.

The business case rested on several assumptions in the club’s “risk register”:

- Technical feasibility of a 15-meter-deep playing surface without structural or drainage failures.

- Environmental efficiency — cooling and comfort without unsustainable energy use.

- Financial return — from matchday revenue, events, and commercial development in the surrounding “sports city.”

- Social license — ensuring community support, accessibility, and credibility of its “climate-smart” branding.

Each assumption was a risk scenario, each mitigation plan a control. What the architects and engineers created wasn’t just a building — it was a living portfolio of risk mitigation.

1: Technical Risk – When Innovation Tests the Limits

The stadium’s design team set a high innovation risk appetite. A sunken bowl had engineering benefits — cooler earth temperatures, improved sightlines, compliance with height restrictions — but also opened a minefield of structural risks and operational risks.

- Groundwater intrusion: In wet winters, seepage could undermine the pitch. Controls? A multi-layer drainage system and constant monitoring — but that means higher OPEX.

- Asymmetric roof loading: The elegant arch-and-cable system is lighter than steel canopies, but subject to uneven wind stress. Key risk indicators here aren’t abstract — they’re the daily strain measurements on the cables.

- HVAC resilience: Passive cooling is elegant, but the contingency plan for a heatwave is active climate control. If power fails during a sell-out match, that becomes an instant operational crisis.

A project’s risk culture determines whether these technical risks are embraced as creative challenges or downplayed as “unlikely.” The real test? Whether, in 20 years, this roof is still standing strong under Cairo’s sun and sandstorms.

2: Environmental Risk – The Heat’s Hidden Costs

Branding the stadium “climate-smart” raised stakeholder expectations. That creates reputation risk — the gap between promise and performance.

Known hazards:

- The digital façade and illuminated roof will draw significant power at night. If the electricity comes from fossil-fuel sources, the operational carbon footprint could spike.

- Irrigation demands for turf and landscaping compete with Cairo’s scarce water supply — a resource dependency risk.

- Extreme weather scenarios — hotter summers, dust storms — could push cooling systems to their limits, shortening asset life.

The mitigation strategy depends on sourcing renewable energy, recycling water, and publishing transparent performance data. Without control effectiveness reviews, “climate-smart” becomes a hollow claim — a classic case of greenwashing risk and encourages project risk assessment.

3: Financial Risk – Balancing Return and Resilience

At an estimated EGP 8–9 billion (≈ USD 180 million), plus high-tech operations, the stadium carries a capital risk profile as ambitious as its design.

Potential triggers in the financial risk register:

- Cost overruns during excavation — subsurface surprises can shred budgets.

- Revenue volatility — football seasons disrupted by climate events or political instability could slash income.

- Maintenance cost inflation — digital façades, tension roofs, and HVAC systems demand specialized upkeep.

Here, scenario planning becomes critical: What’s the break-even point if the stadium runs at 70% capacity for three consecutive seasons? What if a competitor venue undercuts event prices?

Sustainable revenue diversification — concerts, esports, conferences — becomes a risk treatment as essential as any physical cooling system.

Social & Ethical Risk – The Human Factor

A stadium isn’t just concrete and steel; it’s a social organism. The social risk appetite defines whether it integrates with, or isolates itself from, its host city.

Concerns include:

- Accessibility: Located in Sheikh Zayed, far from many working-class fans, the venue risks excluding its most loyal base unless transport links and ticket pricing are managed as equity controls.

- Displacement: Surrounding developments can trigger gentrification, squeezing out small businesses and residents — a community impact risk.

- Trust: If fans perceive the climate narrative as marketing spin without real operational proof, brand credibility becomes the casualty.

Mitigation here is less about engineering and more about engagement — co-designing fan experiences, publishing transparent environmental reports, and reinvesting in community programs.

Lessons from Fellow Risk-Takers

Al-Ahly isn’t the first to face these challenges. In Qatar’s 2022 World Cup, Al-Wakrah Stadium used active bowl cooling — under-seat nozzles and air diffusers that recycled chilled air. It worked, but at the cost of high energy dependency — an example of mitigation creating secondary risks.

Frankfurt’s Commerzbank Arena took a different path — installing advanced operational risk controls to reduce heating costs by up to 85%. It’s a reminder that control effectiveness often hinges on smart monitoring, not just physical design.

Both examples underline that in mega-projects, residual risk is inevitable. The winning strategy is to track it, adapt to it, and communicate it before it communicates itself through failure.

Final Whistle: Turning Risk into Legacy

As the match in our opening scene kicks off, the stadium hums — shade holding, airflow moving, turf glistening. On this day, the controls work. But every day after is another entry in the climate risk log.

The truth is, Al-Ahly’s climate-smart stadium isn’t just a sports venue. It’s a living ERM system, where every game day is a stress test against its risk appetite statement.

The success of this project won’t be measured only in trophies or ticket sales, but in how well it tracks key risk indicators, adapts mitigation strategies, and fosters a risk culture that treats transparency as the 12th player.

If it gets that right, the stadium won’t just beat the Cairo heat — it will set a precedent for climate-resilient, risk-aware sports infrastructure worldwide.