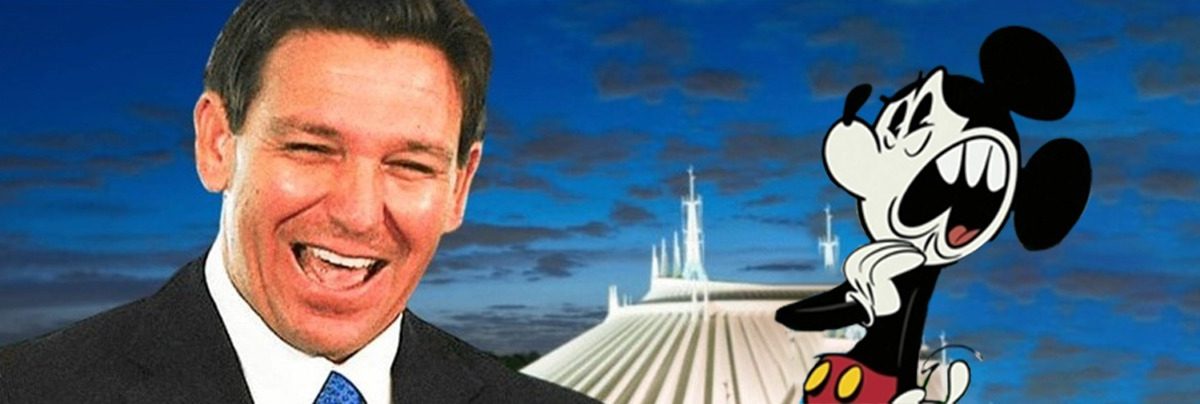

Over the past few years, I’ve come across some strange headlines but few that can contest – ” DeSantis -1, Mickey Mouse -0”

If you’re as bemused at reading this headline as I was, allow me to establish some context. Ron DeSantis is the Governor of the State of Florida in the U.S. and Mikey Mouse is……(I’m sure you’re well aware!).

Why is the Governor of Florida and a candidate for the next republican vote in the 2024 Presidential Elections fighting one of our most beloved cartoon characters, you may ask. How does victory over Mickey help his political profile is another valid question. It did nothing for Peg Leg Pete. De Santis and Bob lger find themselves on the wrong side of what that they see as ‘socially acceptable’.

In other news, why has BlackRock CEO Larry Fink become the villain for the fight against wokeism? How does the face of the world’s largest asset manager cross lines with Wokeism, what critics of this movement called a form of pseudo populism. His critics argue that he may have taken his stance on environmental activism and its impact on societies, too far. Astonishingly, the companies that rely on Blackrock for Capital and are on the wrong side of his beliefs, aren’t very pleased with his environmental and social consciousness. What the hell, Larry?!

Why did Elon Musk tell the Disney CEO (in the fire again, eh?!) to go f**k himself. The owner of X was talking shop on CNBC on the heels of his recent Israel visit, and in the wake of antisemitism allegations – he fired away about the exodus of corporations cutting ties with him.

Why are corporations cutting ties with the poster child for modern innovation? Answer is it’s because of a social agenda that Musk purports. “Apparently” his social disposition doesn’t align with the corporate identity that some leaders see as integral to the organizations they lead.

Politics, Technology, and Asset Management aside, manufacturers of Budweiser beer weren’t spared from this judgment either, on this type of supposed, profound social posturing. On the back of its recent advertising campaigns, Anheuser-Busch too has been at the receiving end of this extremely polarizing tug-of-war between woke ideologies and right-wing conservatism.

Politics v/s Financial Services v/s Social Media v/s Entertainment v/s Beverages – across a wide spectrum of sectors, Social Risks and the ‘S’ in ESG grow to become a more pronounced consideration as the quintessential corporation looks to become its person. The same Western societies that grant non-human entities personhood are being forced to find a solution to how this non-person can defend its social beliefs or lack thereof (or those of its leaders?!). How do these factors impact the ecosystem that they operate in? Over the past few years, as the wealthy (to be read as ‘Oppressor’ by their critics) get wealthier and the rest get ‘workers’, you will see that Modern Capitalism has been hit in the face with the politics of identity as opposed to the virtues of meritocracy. What does this mean for Risk?

Pharmaceuticals, Mining / Fracking, Oil and gas aren’t the only sectors that have to constantly mind their social footprint. An organization’s social media presence, leaders’ public engagements, philanthropic acts even – everything leads to judgment because of its tie-ins with whether it is seen as agreeable or not from a social lens.

Personally, as an Enterprise Risk Management practitioner in North American Banking, the Fair Access to Banking Act in the U.S. poses so many questions for the future.

“This Act would prohibit banks from denying fair access to financial services under the standards of woke corporate cancel culture and prevent the weaponization for political purposes.” says the official press release from Congressman Barr. Even though ‘Wokeism’ has made its way to the White House, Microsoft Word will still flag the word as a possible spelling error.

Now, a Bank that has its presence in California and Florida will have to toe the line in a manner such that they aren’t seen as anti-woke by Californians and aren’t seen as woke by those in Florida.

What makes this paradigm that much more amusing (or bemusing) is that this bill is endorsed by the National Shooting Sports Foundation (NSSF), National Rifle Association (NRA), National Mining Association (NMA), Blockchain Association, National Pawn Brokers Association, and the Kentucky Coal Association. Interesting list of endorsees, right? The industries that these organizations belong to were once at the receiving end of governmental wrath not so long back thanks to Operation Chokepoint. Operation Choke Point was an initiative of the United States Department of Justice beginning in 2013 which investigated banks in the United States and the business they did with firearm dealers, payday lenders, and other companies that, while operating legally, were said to be at a high risk for fraud and money laundering.

Today, representatives from the government come to their rescue.

As the pendulum swings and the clocks unwind, right-wing tendencies seem to be coming to the surface as what’s seen as left-leaning gets ‘left’ behind.

As a Risk Manager trying to do right by the organization I work for – what can I do to appreciate these headwinds and apply them in a manner that builds a view which the firm can calibrate its strategies around?

There is no data set to model against. No precedent informs a future direction. And I can almost guarantee that there’s no crystal ball (I checked!). What I have is a framework that I find helpful.

At the micro-level, I’ve found that a balanced perspective helps. Do not impose your personal beliefs on what the common rhetoric is. Expose yourself to a wide range of beliefs to find a center. Reasonability can be established once you find the center, and the median view will present itself. From there, avoid the extremes on the left and the right. Whoever said, all PR is good PR wouldn’t agree with me because what you see in the news most often is always on one side of the spectrum and that’s what makes you go ‘click click click’.

Secondly, at the macro level, appreciate the ‘cycles’. The right-to-left-to-right loop is cyclical. Even though the timing for these cycles isn’t consistent and some may be longer/shorter than the rest, by appreciating how cause and effect find their way into cycles, you’ll be able to preempt how change is the only constant and you can help your organization weigh the pros and cons of how its actions will pan out over the foreseeable approach. The age-old Risk Management virtue of ‘delayed gratification > instant gratification’ will then be easier to practice.

Bob Dylan said it best –

Come gather ’round people – Wherever you roam – And admit that the waters around you have grown – And accept it that soon – You’ll be drenched to the bone – If your time to you is worth savin’- Then you better start swimmin’ or you’ll sink like a stone – For the times they are a-changin’

Come writers and critics – Who prophesize with your pen- And keep your eyes wide -The chance won’t come again – And don’t speak too soon – For the wheel’s still in spin- And there’s no tellin’ who that it’s namin’- For the loser now will be later to win – For the times they are a-changin’

Blog written by – Nakul Natrajan, Senior Manager and Program Lead for the Enterprise Business & Strategic Risk Scenario Analysis Program at TD Bank Group