Insurance products have continuously evolved to address the changing risks in society. As we envision the year 2050, the acceleration of technological innovation, climate change, and shifts in societal norms will continue to create novel risks that will need to be managed. Here’s a glimpse into the potential insurance products of 2050.

- Genomic Data Insurance: As personal genomics becomes widespread, the security and privacy of genomic data will be crucial. Genomic data insurance could offer coverage against unauthorized access, theft, or misuse of one’s genetic information, which could lead to potential discrimination or identity theft.

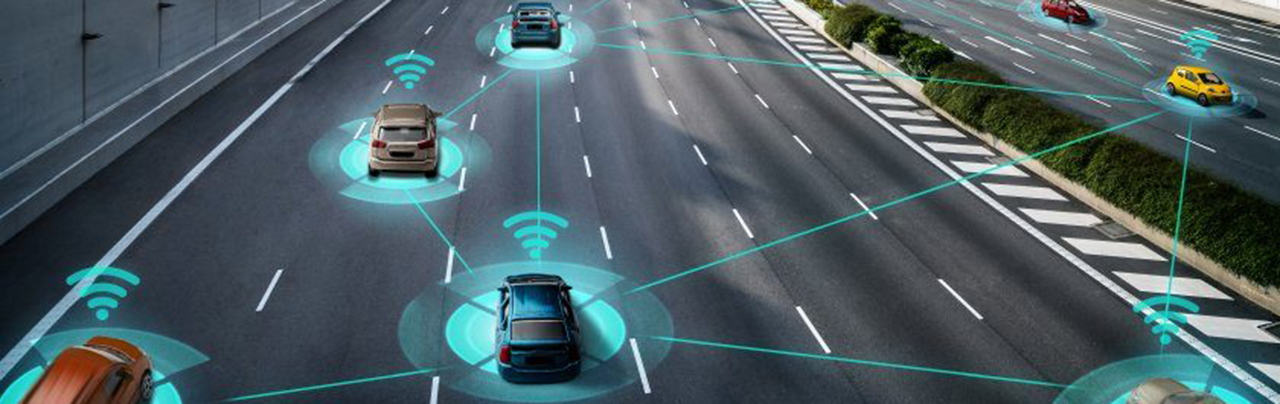

- Autonomous Vehicle Insurance: While autonomous vehicles will likely be commonplace by 2050, there will still be risks related to software glitches, cyber attacks, or unprecedented on-road scenarios. Insurance policies will shift from traditional driver-focused policies to those focused on software integrity, manufacturers’ liability, and cybersecurity.

- Extreme Climate Insurance: Climate change’s impacts will likely intensify by 2050, leading to a rise in extreme weather events. New insurance products may provide comprehensive coverage against losses from extreme heat, increased flooding, severe storms, and more frequent wildfires.

- Human Augmentation Insurance: As advancements in biotechnology lead to possibilities like bio-implants or genetic modification, insurance policies may need to cover potential health risks or malfunction of these augmentations. These could range from sensory enhancements to cognitive or physical augmentations.

- Virtual Reality Insurance: By 2050, virtual reality (VR) may be integrated into daily life. Insurance policies could cover risks related to VR, such as cyber theft of virtual assets, virtual property damage, or health issues arising from long-term VR usage.

- Off-Planet Travel Insurance: As space travel becomes more commercialized, there will be increased need for insurance covering risks related to off-planet travel. Such policies may cover everything from launch risks, health issues in zero gravity, to potential accidents during extraterrestrial explorations.

- Personalized Health Insurance: Advancements in personalized medicine will enable highly customized health treatments. Insurance products may evolve to cover these personalized treatments based on individual genetic profiles, lifestyle habits, and personal health history.

- AI Liability Insurance: With artificial intelligence integrated into many aspects of life, AI liability insurance could cover damages caused by AI decisions. These policies would address the complexity of assigning responsibility between AI developers, operators, and users.

- Work-from-Anywhere Insurance: With remote work becoming the norm, new insurance policies may emerge to cover the unique risks associated with working from anywhere. This could include coverage for home office equipment, cybersecurity, and even potential health issues arising from long-term remote work.

In conclusion, the future of insurance lies in its ability to adapt to emerging risks and societal changes. The year 2050 might seem distant, but anticipating these changes today will ensure that we are better prepared to navigate the risks of tomorrow.