Introduction

Gold holds a special place in India’s economic, cultural, and emotional landscape. It is viewed not only as a symbol of prosperity but also as a source of long term financial security. In recent years, this relationship has deepened further. Domestic gold prices have climbed to historic highs. Reports indicate that the price of twenty four carat gold approached one lakh twenty seven thousand nine hundred rupees for ten grams in November 2025, reflecting a powerful combination of rising global demand and currency fluctuations.

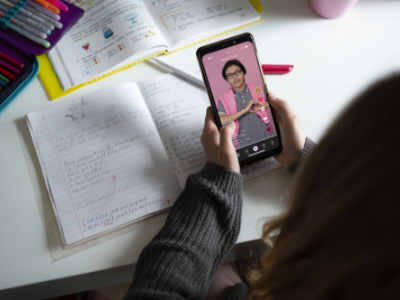

This surge is also visible in changing consumer behaviour. While demand for jewellery has slowed, the appetite for various forms of gold such as exchange traded funds and digital gold has grown. India saw a dramatic jump in gold exchange traded fund investments in 2025, as more individuals shifted from ornamental purchases to investment oriented choices.

However, as attractive as gold may appear, investment in gold carries a complex set of risks that many investors fail to identify. These investment risks range from market volatility and liquidity concerns to counterparty failures in purchasing unregulated digital gold from platforms. There are also operational risks linked to storage, authentication, and insurance of physical gold. The perception of gold as a perfectly safe asset can mislead investors into overlooking these vulnerabilities.

This article therefore adopts a risk management lens to examine India’s gold buying spree. The objective is to outline a comprehensive set of risks, offer practical mitigation measures, highlight common mistakes, and enable investors to build resilient and well informed strategies.

Understanding the Multifaceted Risks Behind Gold Investments

Risk identification is the foundation of any effective risk management process. In the context of gold, investors often understand broad risks such as price volatility, but they may overlook other categories that significantly influence outcomes. The following sections explore these risks in depth –

Market Risk and Price Volatility

Gold is widely perceived as a safe store of value. Yet the global gold market is influenced by a broad spectrum of economic variables such as inflation rates, interest rate decisions, currency values, and investor sentiment. These variables create frequent fluctuations in gold prices. The Indian market is especially vulnerable because India imports a considerable portion of its gold. As a result, the price of gold rises sharply when the rupee weakens, even if global prices remain steady.

Price volatility poses a direct capital risk. If an investor purchases gold during a period of high demand or geopolitical uncertainty, the price may correct once conditions stabilize. In such cases, investors who buy at the peak and sell during corrections face substantial losses.

Although long term trends for gold have been positive, short term fluctuations can be unpredictable and severe. Therefore, understanding the underlying drivers of price movements is essential before making investment decisions.

Counterparty Risk in Paper and Digital Gold

In the past decade, India has witnessed a sharp increase in digital gold platforms and paper gold products. While these instruments offer convenience and liquidity, they introduce counterparty risk. Unlike physical gold stored in a personal vault or bank locker, digital and paper gold rely on third party institutions to hold, safeguard, and manage the assets.

The Securities and Exchange Board of India (SEBI) has repeatedly flagged digital gold as a high risk product because many such offerings fall outside the regulatory framework. Investors therefore have limited legal protection if a provider defaults or fails to maintain adequate reserves.

In India, some platforms do not offer transparent disclosures or independent audits of whether the digital gold backed by claims actually exists. This creates potential for operational failures or fraud. In the worst case, investors may find that their electronic gold units represent nothing more than internal platform credits with no physical gold backing. This makes counterparty risk one of the most critical threats in modern gold investing.

Storage Risk and Insurance Challenges for Physical Gold

Physical gold provides direct ownership but also comes with storage challenges. Holding significant quantities of gold at home increases gold storage challenges such as vulnerability to theft and damage. Bank lockers or private vault services offer greater security but at a recurring cost. These costs include locker rentals, insurance coverage, and additional charges for secure handling.

Insurance for gold can be costly and is often subject to stringent conditions. Some policies may not cover physical gold risks like loss during transit or may require regular assessment of value. While professional vaults reduce the risk of theft, they also introduce costs that can erode long term returns. For smaller investors, these expenses may be disproportionately high.

Liquidity Risk for Certain Forms of Gold

Although gold is generally considered a liquid asset, liquidity varies across forms. Jewellery often carries high making charges that cannot be recovered during resale. Some forms of bullion may attract lower resale prices if purity markings are absent or if the buyer is unable to authenticate the product quickly.

Paper gold and exchange traded funds usually offer better liquidity, but investors may still face bid-ask spreads or market discounts during periods of volatility. For certain platforms delivering digital gold, liquidity depends entirely on the platform itself. If the platform faces operational constraints, withdrawals or redemptions can be delayed or suspended.

Risk of Counterfeit or Impure Gold

The global gold market is not immune to counterfeit risk. Stories of fake gold bars filled with tungsten or plated items passed off as high purity bullion highlight authenticity risk. Investors who purchase from unverified sellers face a significant chance of acquiring counterfeit gold. These items may pass preliminary visual inspection but fail laboratory purity tests.

In India, hallmarking regulations have improved, yet counterfeit and substandard gold continues to circulate. Purchasing gold from private individuals or unaccredited dealers magnifies this risk.

Macro-Economic and Regulatory Risks

India is one of the world’s largest gold importers, which makes the domestic gold market sensitive to international policy changes, supply chain disruptions, and fluctuations in import duties. Government agencies may revise duty structures to manage demand or control the current account deficit. Changes in tax policy can influence both price and investor behaviour.

India needs a long term gold policy to reduce supply uncertainty. Mismatched policy responses and changing global conditions require India to develop a coherent strategy to manage its dependency on imported gold.

These regulatory and macro level uncertainties create additional layers of risk that investors must monitor.

How to Manage Risks When Investing in Gold?

Risk mitigation involves selecting and implementing measures that reduce the likelihood and impact of identified risks. In the context of gold investment risks, mitigation requires a combination of diversification, secure storage, informed selection of investments, and ongoing monitoring.

Diversification Across Multiple Gold Products

Instead of concentrating all holdings in a single format, investors should diversify investments across physical gold, regulated exchange traded funds, and sovereign gold bonds. Physical gold can provide tangible security, regulated financial instruments can offer liquidity, and sovereign gold bonds can deliver interest income.

Diversification spreads risk across different categories and reduces exposure to vulnerabilities linked to any single investment format.

Choosing Regulated and Transparent Investment Channels

Given the risks associated with unregulated platforms, investors should prioritize gold products that fall within formal regulatory oversight. Exchange traded funds and exchange traded receipts provide clear disclosures, audited reserves, and transparent pricing. Products listed on stock markets also offer reliable liquidity.

Regulated instruments reduce counterparty risk and enhance investor protection.

Secure Storage Solutions for Physical Gold

If investors choose to hold physical gold, they should adopt a structured approach to storage. This may include the use of bank lockers, professional vaulting services, or insured storage facilities. It is also important to maintain proper documentation of purity certification and purchase receipts.

Secure storage minimizes operational risks, while insurance coverage offers protection from unforeseen events.

Disciplined Purchasing and Portfolio Monitoring

Gold investing requires consistent monitoring of market conditions, economic indicators, and global developments. Investors should track inflation data, interest rate trends, and currency movements. During periods of excessive volatility or speculative mania, disciplined investors may choose to accumulate slowly rather than make large purchases at uncertain price points.

Regular review also involves rebalancing gold holdings to align with evolving financial goals and market dynamics.

Applying Risk Management Principles to Gold Investment

IRM’s risk management framework emphasizes systematic processes for identifying, assessing, mitigating, and monitoring risk. Applying these principles can help investors build a more resilient gold investment strategy.

1.Establishing Context and Investment Objectives

Investors should begin by clarifying their goals. Is gold intended as a long term store of value, a hedge against inflation, a crisis buffer, or a source of short term gains. Each objective carries different risk implications and may require different allocation levels.

2. Risk Identification and Assessment

At this stage, investors map all possible risks. The risks described earlier, such as market volatility, counterparty exposure, liquidity constraints, authenticity threats, and macro economic pressures, should be documented. Investors can conduct risk assessments and then evaluate the probability of each risk and its potential impact on their financial position.

3. Risk Evaluation and Estimation

This stage involves estimating potential loss scenarios. For example, how would a ten percent fall in gold prices affect the portfolio. What would happen if a platform offering digital gold failed. How much capital is exposed. Risk Prioritisation involves focusing mitigation efforts on high impact and high probability risks.

4. Risk Mitigation

Mitigation strategies include diversification, secure storage, selection of regulated instruments, disciplined allocation, and regular monitoring. Investors may also choose to limit exposure to high risk products such as unregulated digital gold.

5. Monitoring and Review

Gold markets are dynamic. Regular review ensures that investors remain informed about changes in global conditions, regulatory updates, and shifts in personal financial circumstances. Reviews should occur at fixed intervals or when significant events occur.

6. Governance and Documentation

Maintaining accurate records of gold purchases, storage contracts, insurance documents, and investment statements helps investors maintain governance and accountability. This documentation is also essential for tax reporting and estate planning.

Common Mistakes to Avoid When Buying Gold

Many investors fall into predictable traps during periods of high demand. The following mistakes can undermine long term outcomes –

Buying During Price Peaks Without Due Diligence

Investors often react emotionally during price rallies, purchasing gold out of fear of missing out. These purchases frequently lead to losses when markets correct. Emotional decisions reduce the effectiveness of long term strategies.

Overexposure to Unregulated Digital Gold

Many platforms offering digital gold are not regulated and lack adequate investor protection. SEBI has issued warnings about digital gold risks. Overreliance on such products can lead to complete loss if the provider fails.

Ignoring Storage and Insurance Costs

Physical gold requires secure storage. Failing to consider costs such as locker rentals and insurance premiums can reduce the overall return on investment.

Assuming Gold Always Protects Against Inflation

While gold has historically protected purchasing power, there are periods when it has not kept pace with inflation. Therefore, investors must avoid assuming gold will always outperform during inflationary cycles.

Treating Gold as a Primary Income Generating Asset

Gold does not produce cash flow. Investors expecting regular income from gold may be disappointed. Gold can be viewed as a stabilizing asset rather than an income generator.

Conclusion

India’s gold buying spree has unfolded in a context of economic uncertainty, shifting consumer preferences, and rapidly evolving investment products. While gold remains a valuable asset for wealth preservation, it is not free from risk. Investors must understand that risk free investing is a myth. Every asset class carries vulnerabilities, and gold is no exception.

By applying structured financial risk management principles, investors can avoid emotional decisions and build strategies that reflect their financial goals. Diversification, disciplined allocation, secure storage, and reliance on regulated instruments can significantly reduce exposure to hidden risks.

The objective is not to eliminate risk entirely. The purpose of the risk management process is to understand risk, measure its potential impact, and take informed actions that protect capital while allowing for long term growth and stability. With a thoughtful and strategic approach, gold can continue to play a meaningful role in strengthening financial security for millions of Indian households.

FAQS

1.What are the risks of investing in gold?

The risks of investing in gold are as follows –

- The gold market is influenced by economic variables such as inflation rates, interest rates, and currency values. These create fluctuations in gold prices.

- Price volatility poses a direct capital risk.

- Some platforms do not offer disclosures or audits of whether the digital gold backed by claims actually exists. This makes counterparty risk a threat in modern gold investing.

- Holding gold at home increases vulnerability to theft and damage.

- Liquidity Risk – Investors may face bid-ask spreads or market discounts during periods of volatility. If the platform delivering digital gold faces operational constraints, withdrawals can be delayed or suspended.

- In India, counterfeit gold continues to circulate. Purchasing gold from unaccredited dealers magnifies this risk.

- India’s domestic gold market is sensitive to policy changes, supply chain disruptions, and fluctuations in import duties.

2. Is digital gold safe? What risks should an investor be aware of?

Digital gold platforms and paper gold products have increased in India. While these instruments offer convenience and liquidity, they introduce counterparty risk. Digital and paper gold rely on third party institutions to hold, safeguard, and manage the assets.

SEBI has repeatedly flagged digital gold as a high risk product because many such offerings fall outside the regulatory framework. Investors therefore have limited legal protection if a provider defaults or fails to maintain adequate reserves.

In India, some platforms do not offer transparent disclosures or independent audits of whether the digital gold backed by claims actually exists. This creates potential for operational failures or fraud. Investors may find that their electronic gold units represent nothing more than internal platform credits with no physical gold backing. This makes counterparty risk a critical threat in modern gold investing.

3. How does the risk exposure of investing in gold ETFs/mutual funds compare with the risks of owning physical or digital gold?

- A key risk with holding physical gold—such as coins or bullion bars—is the additional burden of secure storage and insurance. These measures introduce ongoing costs that investors typically avoid when using paper or digital alternatives like gold ETFs and gold funds.

- Gold ETFs and mutual funds allow investors to track gold price movements with the added advantages of high liquidity and professionally managed structures.

- SEBI has repeatedly flagged digital gold as a high risk product because many such offerings fall outside the regulatory framework. Investors therefore have limited legal protection if a provider defaults or fails to maintain adequate reserves.

- Assessing one’s risk tolerance is essential for determining suitable gold investment strategies. Conservative investors may gravitate toward physical gold or ETFs, whereas those with higher risk appetites might incorporate mining stocks or leverage strategies.