What Is Credit Risk?

The risk that arose due to the failure of the borrower to repay a loan or to adhere to the obligations of a contract is known as credit risk. The lenders bear this financial risk for the interest they earn on the loan. Based on the factors due to which credit risk arises, it can be classified into:

1) Credit Default Risk

2) Concentration Risk

3) Country Risk

Since the purpose of this blog is to make you understand credit risk management I think just knowing the types of credit risk is enough. Let me know in the comments if you want a detailed blog on types of credit risk.

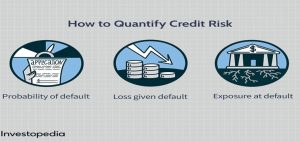

Source: Investopedia

What Is Credit Risk Management (CRM)?

Is CRM the process of credit risk mitigation? WRONG. How can you manage something you don’t measure? The overall process involved in managing credit risk is firstly measuring your risk exposure, then risk assessment and finally mitigating the risk involved by taking necessary measures. Firstly the lender needs to know the amount of capital it can risk to gain the reward of interest on that capital. For that, the lender needs to review its balance sheet and cash flow statements to determine the capital it can risk, and based on the return the lender intends to receive they need to decide the interest rate.

After deciding all these factors now comes the part of risk mitigation. The first step in this process is the selection of borrowers and for that, you can follow the 3 C’S of Credit framework.

- Character: By character, I mean the reputation and the credibility of the borrower. You need to analyse the credit history of the borrower and also need to do background research on the borrower.

- Capacity: The ability of the borrower to oblige to the terms of the contract. The capacity is measured by analyzing the network, CIBIL score, value of assets, and the liquidity of the borrower’s assets.

- Condition: This involves the process of identifying the purpose for which the credit is being taken. It also involves examining the external macro factors (Central Bank Intrest Rates, Currency Rate And Other Geopolitical And Economic Situations) which may prove a risk.

Once the examination of the borrower is done and the borrower is found fit to receive the credit then comes the process of periodic monitoring of the credit and taking measures to ensure that the borrower obliges to the terms mentioned in the contract. One other way to mitigate the risk is by insuring the contract but this again reduces the return lender earns on his capital as he has to pay the insurance premium.

To conclude we can say that just like any severe disease, the pain caused by credit risk can be significantly reduced In the initial stage of lending credit. A proper background check of the borrower, the probability of default and capital exposure must be checked before lending the money to the borrower.

Blog author: Samveg Gala – Student Risk Committee Member, IRM India Affiliate