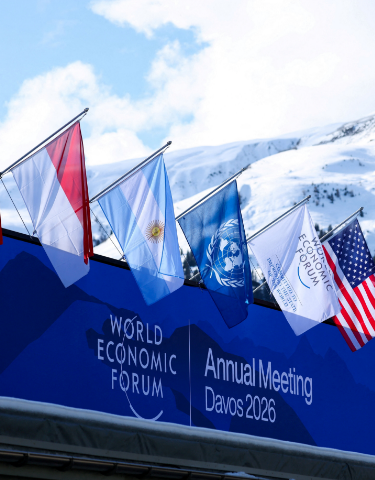

The 56th World Economic Forum Annual Meeting convened nearly 3,000 global leaders from 130 countries under the theme “A Spirit of Dialogue,” producing critical insights for risk management professionals navigating an era of radical uncertainty. For India’s Chief Risk Officers, the deliberations offered a strategic roadmap for addressing converging threats that respect neither organizational silos nor national boundaries. Here are the 21 essential risk and resilience conversations that emerged from Davos 2026, validated by official WEF reports and participant testimonies.

1.Cybersecurity as India’s Systemic National Vulnerability

What: High-level panels explicitly identified cybersecurity as India’s most severe immediate risk, with the Global Risks Report 2026 ranking it as the country’s top threat. Discussions revealed that India recorded 369.01 million malware detections in 2025 alone, with trojans and sophisticated infectors dominating attack vectors. The conversation extended beyond technical IT failures to encompass systemic risks that can undermine elections, financial systems, power grids, and public trust.

Why this is important: India’s rapid digital leap in governance (DBT, Aadhaar-linked services), finance (UPI, fintech), and critical infrastructure has outpaced cyber resilience capabilities. The concentration of data and digital platforms creates single-point vulnerabilities and digital risk that transform cyber insecurity from a technical issue into a strategic national risk. For CROs, this means cybersecurity can no longer be delegated solely to CIOs—it requires board-level accountability, whole-of-organization governance, and integration with enterprise risk management frameworks.

2. Geoeconomic Confrontation as the Global Risk Supercycle

What: The Global Risks Report 2026 identified geoeconomic confrontation as the single most severe global threat for 2026, overtaking armed conflict and climate risks. Sessions explored how tariffs, sanctions, investment screening, and technology restrictions are fragmenting the global economy. Leaders noted that economic risks are rising at the fastest pace among all risk categories in the short term.

Why this is important: India faces record foreign portfolio investment outflows of USD 18.9 billion in 2025, driven by global trade tensions, currency volatility, and fears of US tariffs. For Indian CROs, geoeconomic shocks represent a direct threat to capital flows, supply chain continuity, and export markets. The conversation emphasized that resilience requires treating market risk, particularly geoeconomic risk as a strategic variable in capital allocation decisions, diversifying supply chains beyond traditional hubs, and building counter-cyclical fiscal buffers.

3. AI Governance and the Frontier Technology Paradigm Shift

What: Multiple sessions focused on the technological paradigm shift from AI and quantum computing to next-generation biotech and energy systems. A critical panel featured Turing Award winner Yoshua Bengio warning that AI power concentration poses global vulnerabilities similar to oil dependency, with middle powers like India needing to diversify access to avoid over-dependence. The discussion emphasized establishing global rules and red lines for AI development before catastrophic outcomes emerge.

Why this is important: As AI begins running larger fractions of national economies, Indian CROs face unprecedented AI risks ranging from model failures and security vulnerabilities to social fractures from unemployment and weakening consumer confidence. The conversation highlighted that AI introduces a new and complex attack surface that malicious actors can exploit. For Indian organizations, this requires embedding governance and compliance early in AI adoption, establishing ethical guardrails, and building scenario plans for AI-driven disruptions.

4. Supply Chain Resilience as Structural Imperative

What: The Forum’s supply chain report declared that “volatility is no longer a temporary disruption; it is a structural condition leaders must plan for”. Tata Steel CEO TV Narendran explained that the current period has “permanently changed the way you look at supply chains,” with cost optimization giving way to resilience premiums. Nearly three in four business leaders now prioritize resilience investments, viewing resilience as a driver of competitive advantage.

Why this is important: For Indian CROs managing manufacturing and export operations, supply chain resilience requires moving from reactive contingency planning to proactive ecosystem coordination. The conversation revealed that countries with large domestic markets and abundant raw materials—like India—are “reasonably well positioned”. However, success demands building optionality through flexible capital allocation, modular operational plans, and strategic partnerships across regions.

5. Climate Risks Within Planetary Boundaries

What: Sessions emphasized that nature loss impacts 75% of Earth’s land and poses significant economic risks, yet transitioning to nature-positive business models could unlock $10 trillion annually by 2030. Gita Gopinath highlighted that pollution costs India far more than tariffs, representing a sustained and wide-ranging economic effect that deserves greater policymaker attention.

Why this is important: Indian CROs must integrate climate and nature risks into core business strategy, not just corporate social responsibility. The conversation stressed that extreme weather events, biodiversity loss, and ecosystem collapse represent long-term risks that can disrupt operations, supply chains, and market access. For risk leaders, this means embedding climate resilience into capital expenditure decisions, evaluating nature-based solutions for risk mitigation, and preparing for potential carbon border adjustments that could affect export competitiveness.

6. Inequality as a Risk Multiplier

What: The Global Risks Report identified income and wealth inequality as India’s second-biggest risk, highlighting how high inequality amplifies distress among informal workers during crises like pandemics and inflationary episodes. Discussions emphasized that inequality weakens social cohesion and amplifies the impact of external shocks on governance and economic stability.

Why this is important: For Indian CROs, inequality represents a systemic risk that affects workforce stability, consumer demand, and social license to operate. The conversation revealed that insufficient public services and social protections create vulnerabilities that cascade into business continuity risks when social unrest occurs. CROs must work with HR and corporate affairs teams to ensure inclusive growth strategies, robust employee support systems, and community engagement programs that build societal resilience.

7. Multi-Stakeholder Partnerships for Systemic Risk

What: High-level sessions consistently emphasized that risk does not respect organizational boundaries; it flows through networks. Public-private partnerships, cross-sector dialogues, and international coalitions surfaced as necessary mechanisms to address systemic risks such as supply chain fragmentation, climate exposure, and public health vulnerabilities.

Why this is important: Indian CROs operating in isolation cannot effectively manage risks that transcend organizational boundaries. The conversation highlighted that advanced scenario planning, real-time risk sensing, and collaborative governance now define organizational resilience. For Indian companies, this means actively participating in industry consortia, engaging with government on policy development, and building information-sharing networks with peers.

8. Adaptive Governance Structures

What: Sessions revealed that traditional governance models are increasingly insufficient in a world defined by rapid change. Delegated authority, empowered risk identification committees, and agile decision-making frameworks appeared frequently in discussions. Leaders who maintain rigid hierarchies increase governance risk and respond slowly to fast-moving crises.

Why this is important: Indian CROs must advocate for governance evolution that matches the velocity of emerging risks. The conversation emphasized that boards and executive teams should integrate risk considerations into strategic planning cycles, reward long-term resilience outcomes, and foster environments where dissent and challenge are valued. For Indian organizations with hierarchical traditions, this represents a cultural transformation.

9. Digital Public Infrastructure and Sovereignty

What: India’s digital public infrastructure (DPI) featured prominently as a strategic asset, with leaders noting that DPI is one of the critical infrastructures for future growth. However, discussions also highlighted the need for digital sovereignty through secure compute capacity, sustainable data centre ecosystems, and DPDP-aligned frameworks.

Why this is important: Indian CROs in financial services, telecom, and critical infrastructure must ensure that digital sovereignty strategies balance innovation with resilience. The conversation revealed that data concentration creates single-point vulnerabilities that can become national security issues. CROs should advocate for distributed architectures, quantum-resistant encryption standards, and robust data protection governance.

10. Trade Rewiring and Regionalization

What: Davos 2026 made clear that trade is fundamentally changing, with localization becoming the norm as markets seek autonomy from volatile cross-border flows. Qualcomm CEO Cristiano Amon highlighted that India is establishing itself as a critical electronics manufacturing hub as companies diversify away from China. The shift reflects a combination of economic factors, incentives, and supply chain resilience considerations.

Why this is important: For Indian CROs, trade rewiring presents both opportunity and risk. The conversation emphasized that while India benefits from diversification trends, companies must navigate new trade corridors, regulatory regimes, and quality standards. Chief risk officers should evaluate geopolitical risk in market entry decisions, build compliance capabilities for diverse regulatory environments, and assess exposure to potential trade policy reversals.

11. Energy Transition and Security

What: Energy security emerged as a critical risk vector, with discussions highlighting that one data center consumes electricity equivalent to a town of 100,000 households. The conversation emphasized building prosperity within planetary boundaries through secure energy systems. Union Minister Pralhad Joshi pitched a $300-350 billion clean energy investment opportunity for India.

Why this is important: Indian CROs face acute energy security risks that affect both operations and growth prospects. The conversation revealed that electricity is even more basic than digital infrastructure for economic development. For manufacturing and technology companies, energy availability, price volatility, and transition risks around carbon regulations represent critical business continuity concerns. CROs must integrate energy scenario planning into resilience strategies and invest in renewable energy procurement.

12. Human Factor in Risk Intelligence

What: Despite sophisticated analytics and predictive algorithms, risk resilience requires a human dimension rooted in judgment, experience, and ethics. Participants emphasized that risk intelligence is not only about identifying threats but also about understanding values, motivations, and incentives across stakeholders.

Why this is important: Indian CROs must ensure that risk management frameworks incorporate qualitative assessments and ethical considerations alongside technical metrics. The conversation highlighted that algorithms can identify patterns but cannot fully account for cultural context, stakeholder motivations, or emergent human behaviors. For Indian organizations operating in diverse markets, this means building risk teams with multidisciplinary expertise, fostering psychological safety for risk reporting, and ensuring senior leadership maintains direct engagement with risk assessment.

13. Scenario Planning and Strategic Foresight

What: Managing frontier technologies demands collaboration across scientists, policymakers, investors, and civil society. Leaders must anticipate long-term effects by planning today for future risks that may materialize years or decades later. The Forum’s Emerging Technologies report emphasized that nuclear fusion and quantum computing require planning decades before deployment.

Why this is important: Indian CROs must extend their risk horizon beyond traditional two-to-three-year planning cycles. The conversation revealed that strategic foresight is critical—not just asking what technologies can do today, but what happens when they mature, converge, and spread. For Indian companies, this means running scenarios on post-quantum cryptography, abundant clean energy geopolitics, and widespread gene editing implications.

14. Technology as Enabler and Risk Vector

What: While innovation remains a source of competitive advantage, frontier technologies introduce unprecedented risks: operational downtime, cascading cyber incidents, and regulatory exposure. Manufacturing became the most attacked industry in 2024–2025, with ransomware and supply chain exploitation surging. The conversation highlighted technology’s dual role as both resilience enabler and systemic risk amplifier.

Why this is important: Indian CROs face a fundamental paradox: digital transformation is necessary for competitiveness but expands the attack surface. The conversation emphasized that AI-driven processes can halt production across multiple sites from a single failure point. For Indian manufacturers adopting Industry 4.0 technologies, this requires secure-by-design principles, operational technology (OT) security separate from IT security, and supply chain security assessments for technology vendors.

15. Skills Transition and Workforce Resilience

What: The human dimensions of transformation spotlighted how governments and businesses must invest in people, building resilient workforces and supporting skills transitions. Leaders acknowledged that while AI will help with economic growth, young people entering the job market face increasing difficulties. The conversation emphasized continuous workforce development through outcome-oriented apprenticeships. WEF research shows that human-centric skills—creativity, critical thinking, resilience, empathy—are critical yet remain invisible in job markets.

Why this is important: Indian CROs must recognize that workforce risks directly impact operational resilience. The conversation revealed that skills gaps in emerging technologies create single points of failure in critical functions. For Indian companies scaling AI and automation, this means massive reskilling investments, talent retention strategies, and scenario planning for workforce disruptions. MSDE and WEF signed an MoU to establish a Skills Accelerator focusing on AI, cybersecurity, robotics, and green energy.

16. Nature-Based Solutions and Biodiversity

What: The transition to nature-positive business models could unlock $10 trillion annually by 2030 while addressing climate risks. The First Movers Coalition demonstrated how 900+ organizations eliminated 33 billion single-use items and redesigned 850,000 tonnes of packaging. Discussions emphasized integrating nature-based solutions into infrastructure, food systems, and natural ecosystem protection.

Why this is important: Indian CROs in agriculture, infrastructure, and manufacturing face direct risks from biodiversity loss and ecosystem collapse. The conversation highlighted that nature loss impacts 75% of Earth’s land and poses significant economic risks. For Indian companies, this means evaluating dependencies on natural capital, assessing exposure to water scarcity, and investing in nature-positive solutions that provide both risk mitigation and new revenue streams.

17. Financial Architecture and Debt Sustainability

What: The Sustainable Sovereign Debt Hub aims to transform the $92 trillion sovereign debt market by embedding climate and nature resilience into finance. Global debt now exceeds $300 trillion—close to 90% of global GDP—at record interest rates. The conversation addressed how rising debt levels constrain governments’ capacity to address global risks.

Why this is important: Indian CROs must monitor sovereign debt sustainability as it affects fiscal space for infrastructure investment, social protection, and crisis response. The conversation revealed that debt sustainability directly impacts business operating environments, especially in emerging markets. For Indian companies with government contracts or operating in regulated sectors, CROs should assess sovereign risk in financial risk management and strategic planning, and explore innovative financing mechanisms like sustainability-linked bonds.

18. Regional Security and Geopolitical Tensions

What: The Global Risks Report 2026 highlighted state-based armed conflict and strategic instability as significant risks. Regional geopolitical tensions have intensified India’s security risks, as reflected in the 2025 Pahalgam attack, the blast near Delhi’s Red Fort, and continued cross-border terrorism by Pakistan-backed groups. The conversation emphasized that these tensions create cascading effects on business continuity, supply chains, and foreign investment.

Why this is important: For Indian CROs, geopolitical tensions represent both direct and indirect risks—from operational risk and disruptions in border regions to capital flows and investor confidence. The conversation revealed that political interference in economic systems can accelerate inflation, raise interest rates, and create unpredictability in business environments. CROs should assess exposure to border regions, evaluate currency risks from policy volatility, and build contingency plans for supply chain disruptions.

19. Disinformation and Information Integrity

What: Misinformation and disinformation ranked second on the two-year global risk outlook. Sessions explored how disinformation erodes trust, deepens divisions, and weakens governance. The UN warned that nearly all deepfakes (96%) are pornographic and systematically target women. Moldova’s case illustrated how foreign disinformation networks interfered in elections by disseminating AI-generated deepfakes.

Why this is important: For Indian CROs, disinformation represents a risk to organizational reputation, employee morale, and stakeholder trust. The conversation emphasized that counter-disinformation requires transparency, media literacy, institutional fact-checking, and digital integrity initiatives aligned with the Election Commission of India’s FACT Principle strategy. CROs should champion information security programs, build crisis communication plans for coordinated disinformation attacks, and invest in employee digital literacy.

20. Financial System Stability and Banking Infrastructure

What: SBI Chairman Setty highlighted at Davos that India’s banking system has become resilient following post-2008 reforms, clean-ups, and recapitalization. However, a structural shift is underway: household savings are flowing increasingly into mutual funds and pension funds rather than bank deposits. The conversation also explored blockchain-banking convergence as a new foundation for global finance.

Why this is important: For Indian CROs, financial system stability is foundational to business operations. The conversation revealed that deposit growth lagging credit growth presents funding challenges for banks, which will increasingly access capital markets. For companies, this means incorporating risk management in banking by understanding evolving financing options, monitoring banking sector health, and preparing for structural shifts in financial intermediation. The blockchain-banking convergence introduces both opportunities for payment efficiency and new cybersecurity risks.

21. Pandemic Preparedness and Biosecurity

What: WEF’s Shyam Bishen warned that “we are not very well prepared to handle the next pandemic”. Structural shifts ranging from climate change to geopolitics are making disease outbreaks more frequent, while global coordination to contain them remains fragmented. The conversation highlighted vaccine manufacturing concentration as a major vulnerability: only 1% of vaccines used in Africa come from Africa. The BRIDGE Alliance was launched to build interoperable global disease surveillance networks.

Why this is important: For Indian CROs, pandemic preparedness represents both a national security and business continuity imperative. The conversation revealed that early pathogen detection, rapid data sharing, and decentralized vaccine manufacturing capacity are critical for reducing outbreak-to-pandemic escalation risk and other biosecurity risks. CROs should assess supply chain dependencies on concentrated vaccine sources, build pandemic scenario plans aligned with global surveillance capabilities, and ensure employee health security protocols are current and scalable.

Implications for Indian Chief Risk Officers

The 21 conversations at Davos 2026 converge on a single strategic insight: risk in 2026 is systemic, interconnected, and requires leadership integration rather than technical containment. Indian CROs must move beyond traditional enterprise risk management to embrace strategic risk governance that aligns capital allocation, technology adoption, stakeholder engagement, and long-term resilience planning. The organizations that thrive will be those whose CROs operate at the board level, champion cross-functional collaboration, and treat risk intelligence as a competitive advantage rather than a compliance obligation.

Citations:

- WEF Nature-Based Solutions and Sustainable Debt Hub

- WEF Annual Meeting 2026 theme and reports

- WEF Davos 2026 Digital Infrastructure sessions

- WEF Global Risks Report 2026

- CGTN News, Davos 2026

- WEF Global Risk Report 2026

- Economic Times, AI power concentration

- Indian Express/WEF Global Risks Report 2026

- WEF Balancing intelligent system innovation

- Economic Times, Gita Gopinath on pollution costs

- Business Today, Tata Steel Davos 2026

- Economic Times, Qualcomm India manufacturing hub

- Policy Magazine, Davos 2026 overview

- WEF Press Release, Supply Chain Volatility

- KPMG India at Davos 2026

- WEF/Truth vs Myth in Elections session

- India Today, SBI Banking Resilience

- New Indian Express, Trump and Global Uncertainty

- UN PGA remarks, Davos 2026

- Business Today, SBI Savings Shift

- WEF, Global Finance and Blockchain Convergence

- WEF Global Risks Report 2026 Digest

- Moneycontrol, Pandemic Preparedness Davos 2026

- Economic Times, Dollar Dominance and Debt

- WEF Davos 2026 in Numbers

- Down to Earth, India Clean Energy Investment

- Business Today, MSDE-WEF Skills Accelerator MoU

- WEF Jobs and Skills Transformation 2026

FAQS

1.What are the biggest global risks identified for 2026?

At the forefront of the global risk landscape in 2026 is geoeconomic confrontation. For the first time, it ranks as the most severe short-term risk likely to trigger a crisis. This reflects the increasing use of economic tools like tariffs, sanctions, and trade restrictions as instruments of strategic competition.

Following closely are state-based armed conflict, misinformation and disinformation, societal polarization, and extreme weather events — each embodying distinct yet interconnected causes of instability. Cyber insecurity and adverse outcomes of advanced technologies, notably artificial intelligence, also feature prominently in global risk perceptions.

2.How does Davos 2026 address global risks and resilience?

The high-level sessions at the World Economic Forum Annual Meeting 2026 wove together a tapestry of ideas concerning risk, resilience, governance, and strategic adaptation.

- Panels explicitly identified cybersecurity as India’s most severe immediate risk. This means cybersecurity requires board-level accountability, whole-of-organization governance, and integration with enterprise risk management frameworks.

- Sessions explored how tariffs, sanctions, investment screening, and technology restrictions are fragmenting the global economy. The conversation emphasized that resilience requires treating geoeconomic risk as a strategic variable in capital allocation decisions, diversifying supply chains, and building fiscal buffers.

- A critical panel featured Turing Award winner Yoshua Bengio warning that AI power concentration poses global vulnerabilities similar to oil dependency. This requires embedding governance and compliance early in AI adoption, establishing ethical guardrails, and building scenario plans for AI-driven disruptions.

- Supply chain resilience requires moving from reactive contingency planning to proactive ecosystem coordination. The conversation revealed that success demands building optionality through flexible capital allocation, modular operational plans, and strategic partnerships across regions.

- Sessions emphasized that nature loss impacts 75% of Earth’s land and poses significant economic risks, yet transitioning to nature-positive business models could unlock $10 trillion annually by 2030. For risk leaders, this means embedding climate resilience into capital expenditure decisions, evaluating nature-based solutions for risk mitigation, and preparing for potential carbon border adjustments.

3.Why is the Chief Risk Officer (CRO) role critical in 2026 and beyond?

Risk in 2026 is systemic, interconnected, and requires leadership integration rather than technical containment. As risk landscapes evolve, so too must the role of the Chief Risk Officer. No longer confined to compliance and reporting, the modern CRO is a strategic architect of organisational resilience. To operationalize strategic resilience, CROs should prioritize the following actions:

- Build ERM architectures that unify operational, financial, strategic, and emerging risk data.

- CROs must invest in horizon scanning, scenario modelling, and trend analysis that extends beyond traditional risk registers.

- CROs must embed robust risk governance across functions, aligning strategic objectives with informed risk appetite statements, clear accountabilities, and transparent escalation mechanisms.

- CROs must champion psychological safety, encourage reporting of near misses, and embed risk awareness at all levels.

- CROs should champion strategic optionality — frameworks that provide multiple pathways for response based on real-time feedback and evolving conditions.

- From climate adaptation to cybersecurity, CROs should build alliances across industries, governments, and non-governmental stakeholders.

- CROs should establish processes for after-action reviews, lessons learned capture, and iterative improvement.

The organizations that thrive will be those whose CROs operate at the board level, champion cross-functional collaboration, and treat risk intelligence as a competitive advantage rather than a compliance obligation.