-

Risk in my Life

10 Key risk management lessons from ten diverse brands

Risk management is a critical component of any successful business strategy. Companies across ... -

Risk 360

Why Pollution Risk is more severe than we imagine: Unseen consequences and systemic threats

In the global discourse on environmental hazards, pollution risk is often discussed in ... -

Risk in my Life

How do you assess the impact associated with fake news risk?

Predicting the impact associated with the risk of fake news involves understanding the ...

Risk in my Life

10 Key risk management lessons from ten diverse brands

Risk management is a critical component of any successful business strategy. Companies across various industries ...

Risk 360

Why Pollution Risk is more severe than we imagine: Unseen consequences and systemic threats

In the global discourse on environmental hazards, pollution risk is often discussed in terms of ...

Risk in my Life

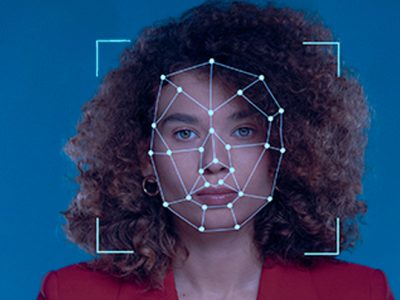

How do you assess the impact associated with fake news risk?

Predicting the impact associated with the risk of fake news involves understanding the various ways ...

Latest News

-

Careers

20 Career Options after Studying Enterprise Risk Management (ERM)

Enterprise risk management (ERM) is a vital function in organizations across various industries. ... -

Startups & SMEs

Safeguarding Your Legacy: Setting Up Risk Management in Family Business

Family businesses hold a unique place in the corporate landscape, often spanning generations ... -

Boardroom

10 Reasons why CEOs need to invest in Enterprise Risk Management (ERM)

CEOs should invest in enterprise risk management (ERM) because it provides several significant ... -

Careers

An In-depth Look at the global IRM Designations in Enterprise Risk Management (ERM)

Enterprise Risk Management (ERM) is an evolving discipline aimed at helping organizations identify, ...